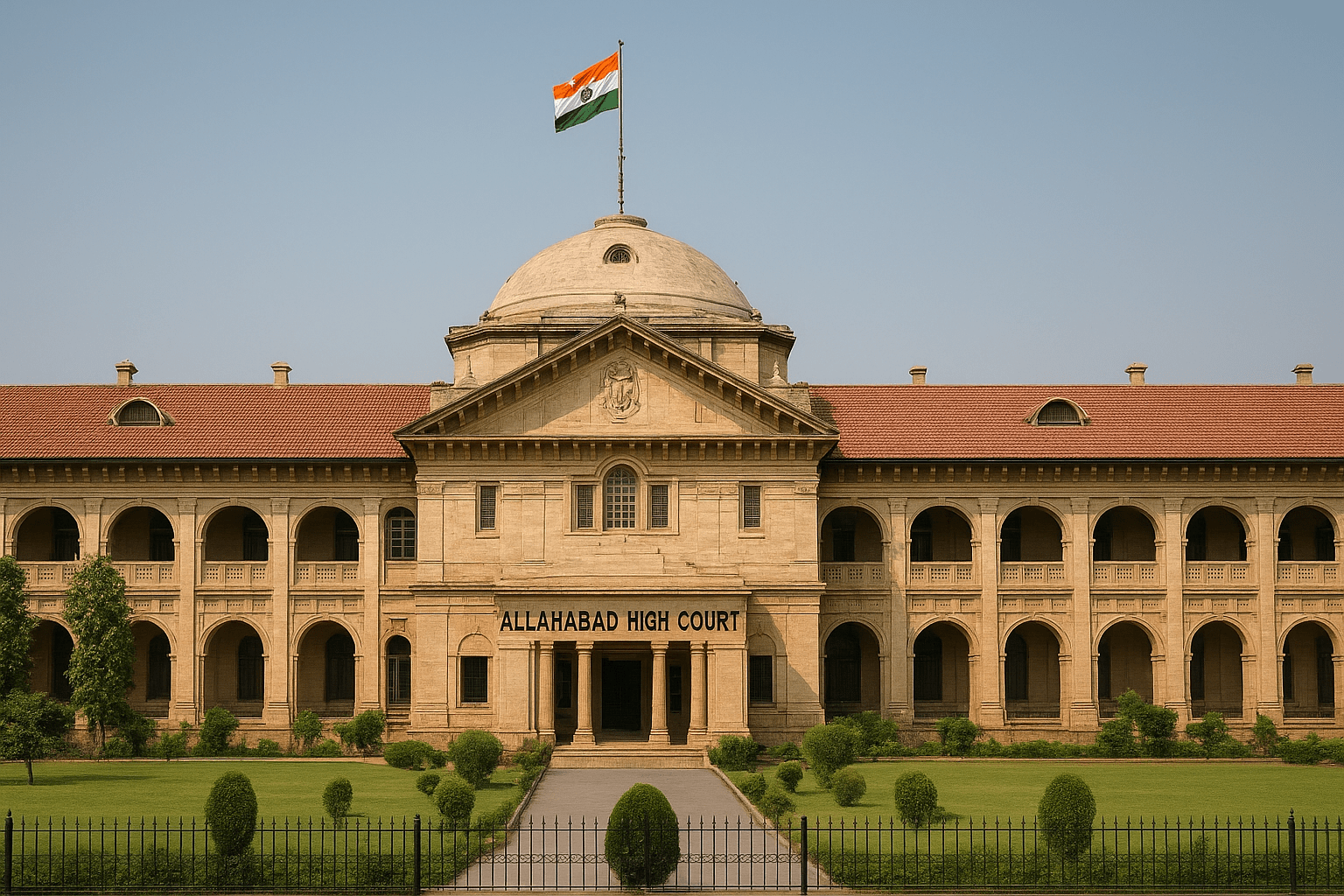

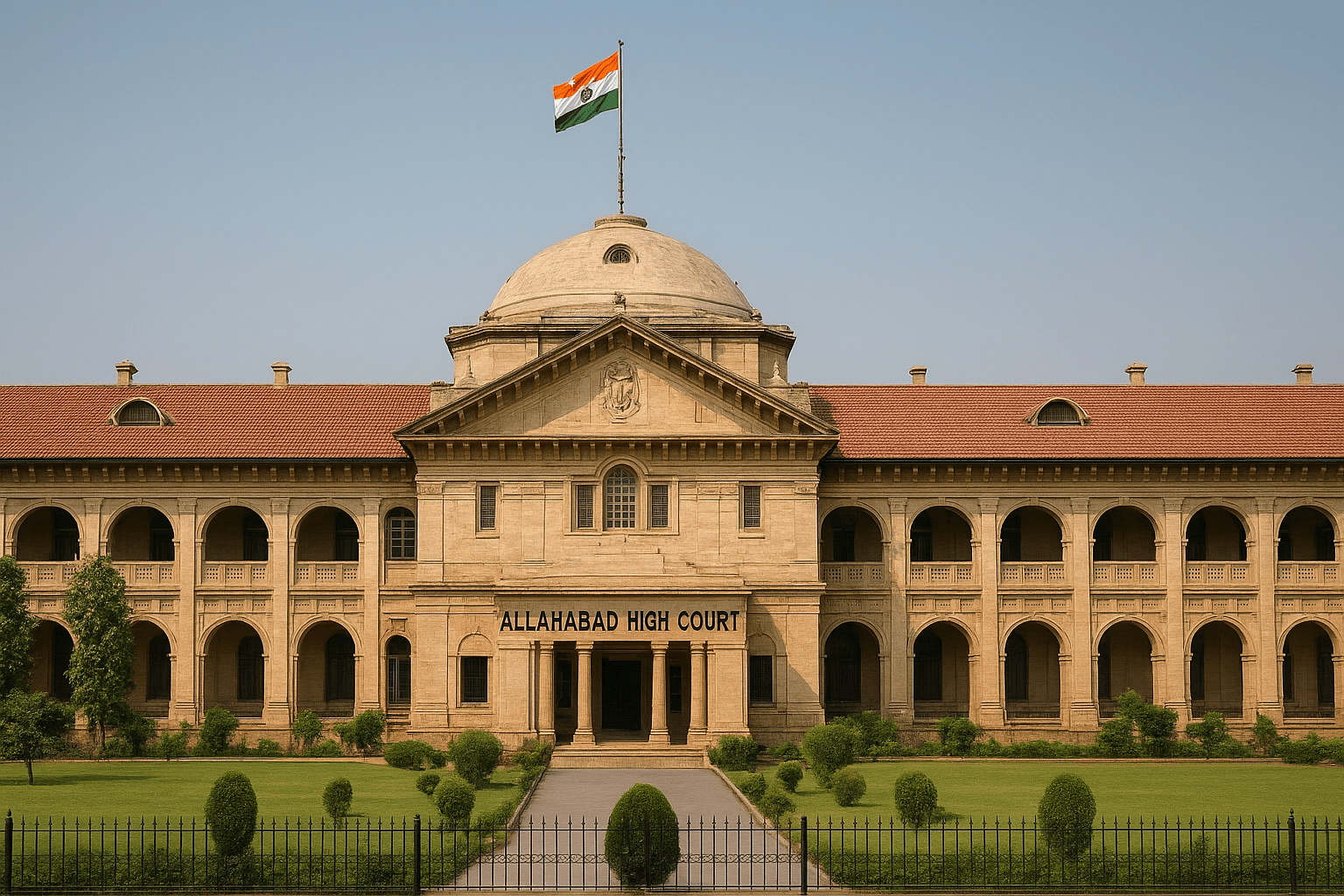

Signals for Alternative Arrangements in Cases of ‘Untraceable’ Accused: Allahabad High Court

The Allahabad High Court has expressed serious concern over the repeated practice of the police submitting reports stating that the accused is “untraceable” or “could not be located”, observing that such stereotyped and evasive reports pose a serious obstruction to the smooth functioning of the judicial process. The Court categorically clarified: “The Police are not … Read more