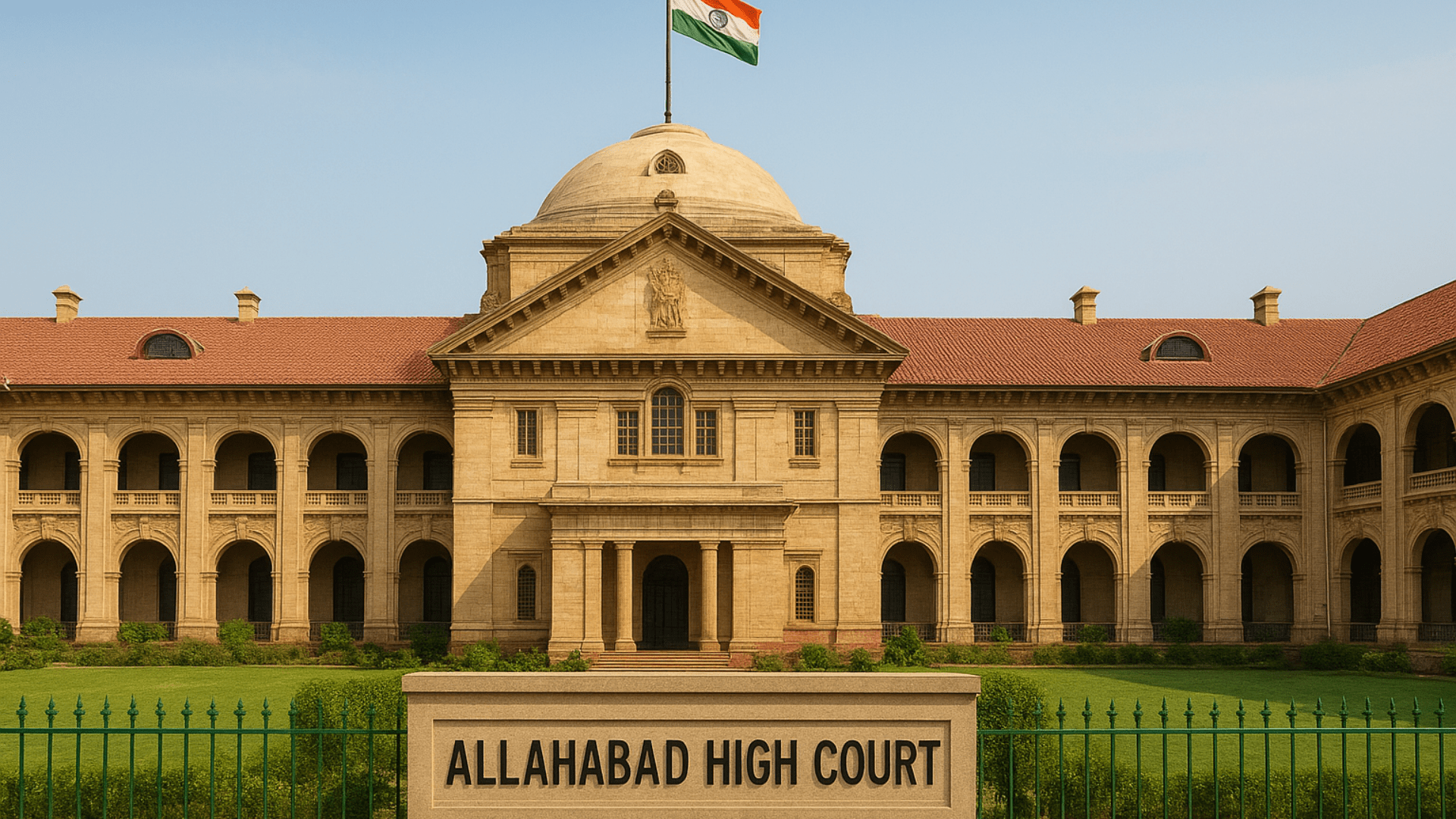

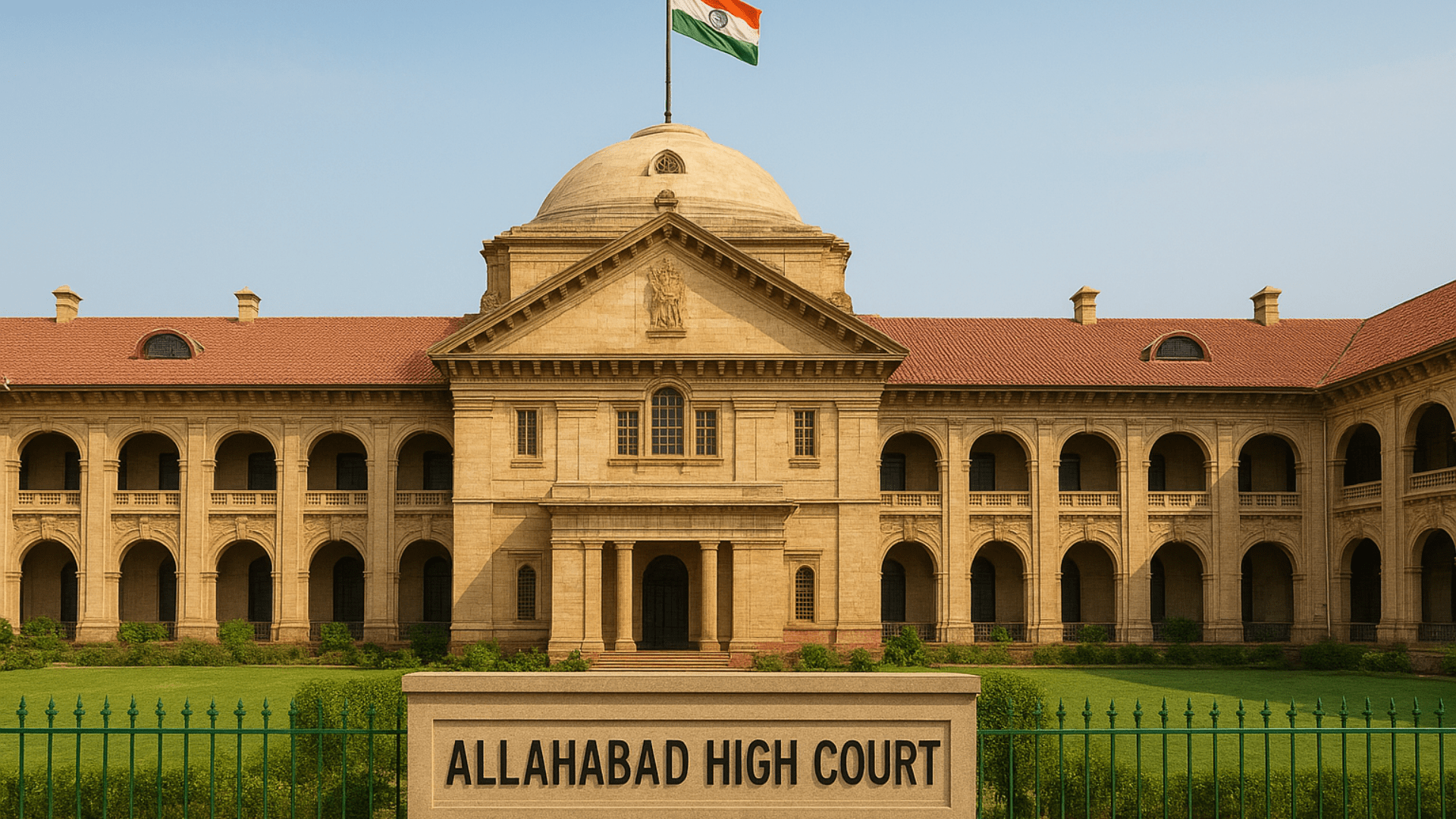

Offence under Section 13 of the Gambling Act is Cognizable: Allahabad High Court

The Allahabad High Court has refused to quash criminal proceedings initiated in connection with allegations of gambling at a public place, clearly holding that an offence registered under Section 13 of the Public Gambling Act, 1867 is a cognizable offence, in which the police are empowered to arrest without warrant and conduct investigation. The order … Read more